per capita tax burden by state

The states with the lowest average combined state and local sales tax rates are Alaska 176 Hawaii 444 and Wyoming 522 while those with the highest average. Delaware follows with 552 and the second-lowest sales and excise tax rate.

States With The Highest And Lowest Property Taxes Property Tax States Tax

Effective state tax rate 50000 taxable income.

. As part of its 2019. Effective state tax rate 50000 taxable income. State and local tax burden.

Rate at highest tax bracket. Rate at highest tax bracket. The effective tax burdens in these states are.

1498 25th lowest General sales tax collections per capita. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each. The five states with the highest tax collections per capita are New York 9073 Connecticut 7638 New Jersey 6978 North Dakota 6665 and Hawaii 6640.

0 tied - the lowest Property tax collections per capita. Per Capita Tax Receipts by State 2015 The following per capita tax receipts describe how much money each state generates from taxes and compares it to the total. Residents pay 44 in property taxes 496 in income tax and 343 in sales tax.

Federal Receipts. We share the overall tax burden by state for an average household to help decide where to move. State by state however this share varies from as little.

211 rows Total taxes thousands Population Per capita State Alabama. Income tax collections per capita. State and local tax burden.

North Dakota ranks first with 7438 per capita and Alaska is second-highest with per capita collections of 7005. 51 rows State Total Tax Burden Property Tax Burden Individual Income Tax Burden. Finally New York Illinois and Connecticut are the states with the highest tax burden for the middle 60 by family income.

Alaska is one of seven states with no state income tax. All told Americans pay just over 5000 a year in state and local taxes equal to 98 of their estimated annual income. Unsurprisingly New York has the largest state tax burden.

The state with the lowest tax burden is Alaska at 516. For most states in the United States the primary means by which state governments take money from their residents is through income taxes. North Dakotans and Alaskans however are only paying a.

Mapsontheweb Infographic Map Map Sales Tax

This Map Shows How Taxes Differ By State Gas Tax What Is Credit Score Better Healthcare

2016 Property Taxes Per Capita State And Local Property Tax Buying A New Home Home Buying

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Monday Map State Income And Sales Tax Deductions Data Map Tax Deductions Map

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Tax Return Income Tax

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Us States With The Highest And Lowest Per Capita State Income Taxes Map American History Timeline Mapping Software

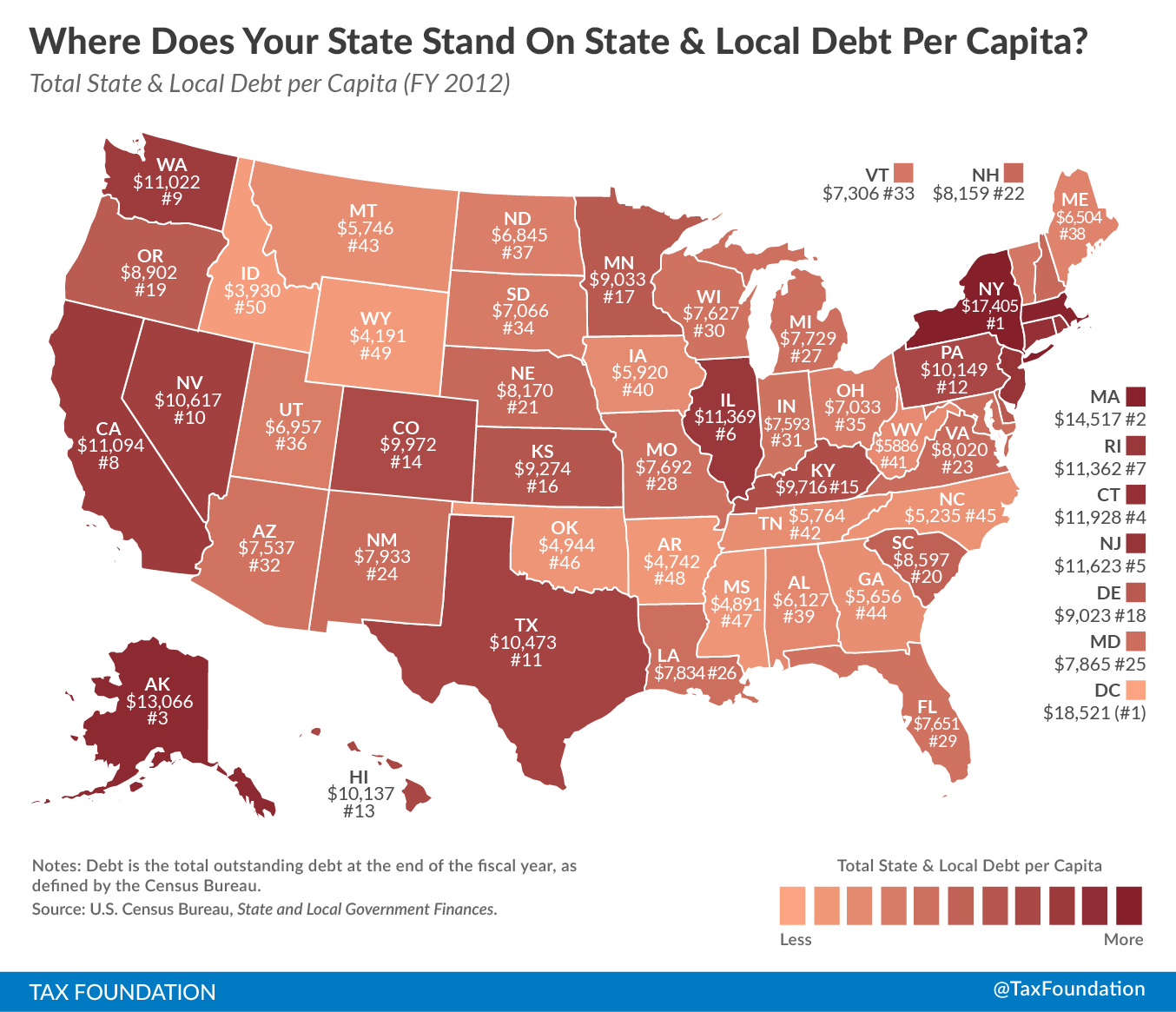

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

A New Map Courtesy Tax Foundation Shows Where Pennsylvania Stacks Up On State Gas Taxes For More On Transpor Infographic Map Safest Places To Travel Fun Facts

U S Cigarette Consumption Pack Sales Per Capita Vivid Maps Map Old Maps Cartography

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times